does stimulus check show as tax refund

Bear in mind that the stimulus checks were based on your 2018 or 2019 tax year information. WCPO Published February 5 2021 30 Views.

Still Didn T Get Your Stimulus Checks File A 2020 Tax Return For A Rebate Credit Even If You Don T Owe Taxes

Does Stimulus Check lower your tax refund.

. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. The Daily Show host is not a fan of the former presidents latest endorsement. Check back for.

The third stimulus check and your tax refund. What You Need to Know About the 2022 One-Time Tax Rebate. A three-part plan delivers on President Bidens promise to cancel 10000 of student debt for low- to middle-income borrowers.

If however you filed your 2021 tax return and reported 0 for your recovery rebate credit and you do want to claim more stimulus money you will need to file an amended return using IRS Form 1040 X. You received by check a tax credit in 2020 that normally would have had to wait until taxes were filed in 2021. 1 to receive the rebate and eligible taxpayers who filed before July 1 should receive payment by Oct.

Under the Recovery Rebate Credit the eligibility and the amount are based on your 2020 tax return. Ronda Rousey Suspended Indefinitely After Attacking Officials At SummerSlam. Virginia taxpayers who had a tax liability in 2021 are eligible for a one-time payment of 250 to individuals and 500 to couples who filed jointly.

Other States Considering Stimulus Refunds. Not every taxpayer is eligible. Using the IRS Wheres My Refund tool.

He says if you tell an online tax program you did not receive a stimulus check it assumes you did not receive yours and automatically gives you an extra 1200 in your refund or an extra 2400. Taxpayers must file before Nov. You may remember these as the 1200 and 600 payments.

Emily Boesen with the Indiana Auditors Office said the state expects to start printing checks Monday morning which means the first checks could arrive by Thursday. Stimulus checks do not count as income so they are not taxable. If youre missing a stimulus check you can claim it as a credit on your upcoming tax return.

This also means that the amount of your stimulus check will not count towards your adjusted gross income and will not push you into a higher. This refund comes in the form of a 125 tax refund issued by direct deposit or check and is separate from any Indiana Individual Income Tax. State residents who have filed their 2021 return by June 30 will get a check for 750 by September 30 thanks to the 1992 Taxpayers Bill of Rights TABOR Amendment while joint filers.

President Biden believes that a post-high school education should. INDIANAPOLIS If you are still waiting on that tax refund check from the state youre not alone. Tax liability is the amount of tax you owe throughout the year minus any credits like the credit for taxes you paid.

Bidens plan limits forgiveness to individuals earning under 125000 per year during tax years 2020 or 2021. Under Indianas Excess Use of Reserves law IC 4-10-22 Indiana must issue a refund to Hoosier taxpayers when the states budget reserves meet certain thresholds which happened for Fiscal Year 2021 and last occurred in 2012. But that doesnt necessarily mean you will get a bigger refund.

They are in essence advances on future tax credits. If you had a tax liability last year you will receive up to 250 if you filed individually and up to 500 if you filed jointly. Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software.

Viewing your IRS account information. The economic stimulus bill passed in 2021 any student debt. Why does it appear your Stimulus Check lowers your tax refund when the IRS says you will not be taxed on the stimulus.

But it wont have any stimulus money from the third most recent round of stimulus checks. Why does it appear your Stimulus Check lowers your tax refund when the IRS says you will not be taxed on the stimulus. 12 officials at the auditors office said the state expects to.

Your 2020 tax refund may include funds from the first and second rounds of direct aid passed by Congress last spring and in late December respectively.

Irs Says Anyone Still Waiting For A Stimulus Payment Should Claim It On Their 2020 Tax Return The Washington Post

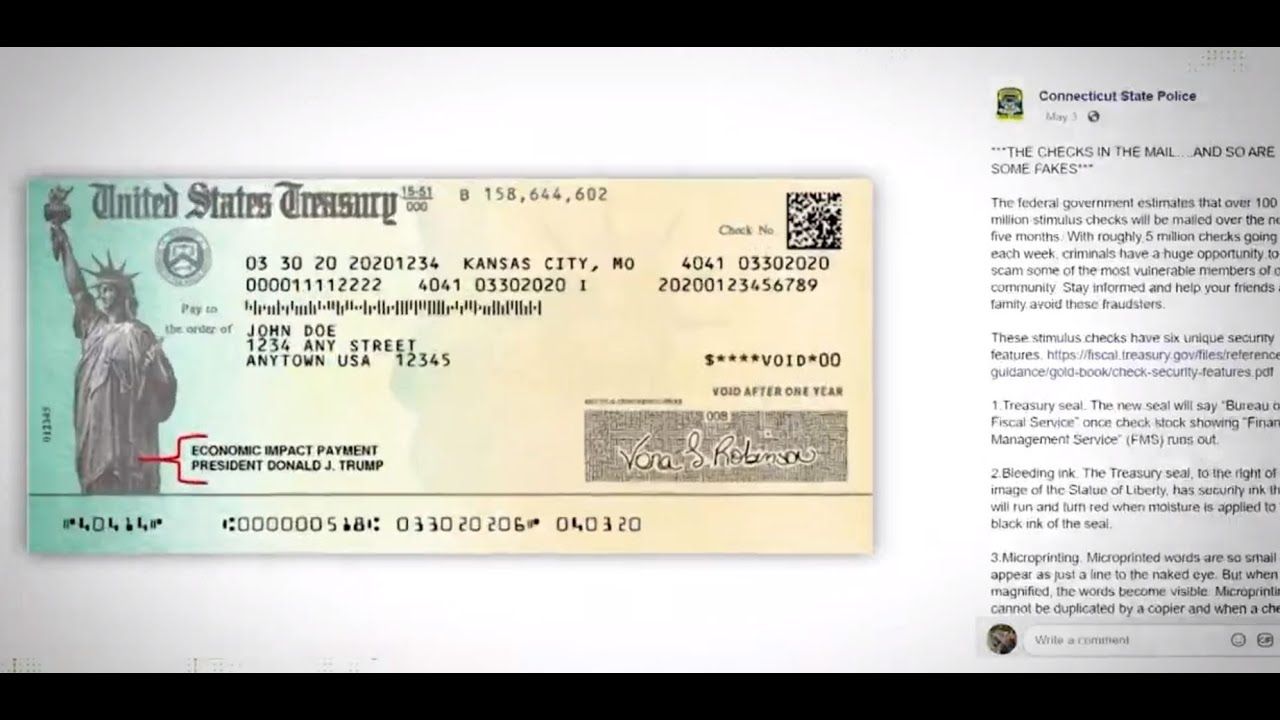

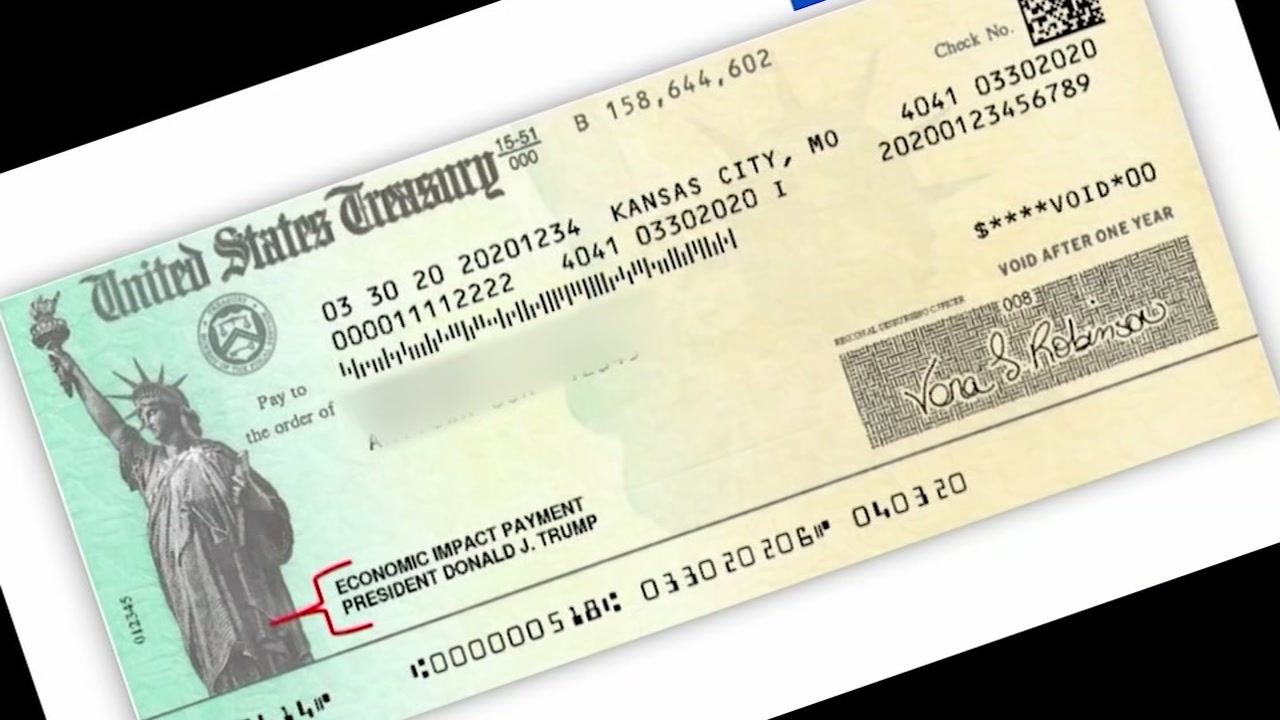

Verify How To Make Sure Your Stimulus Check Is Real Youtube

Still No Third Stimulus Check Track Your Money Now With This Online Tool Cnet

![]()

Can You Track Your Stimulus Check Money

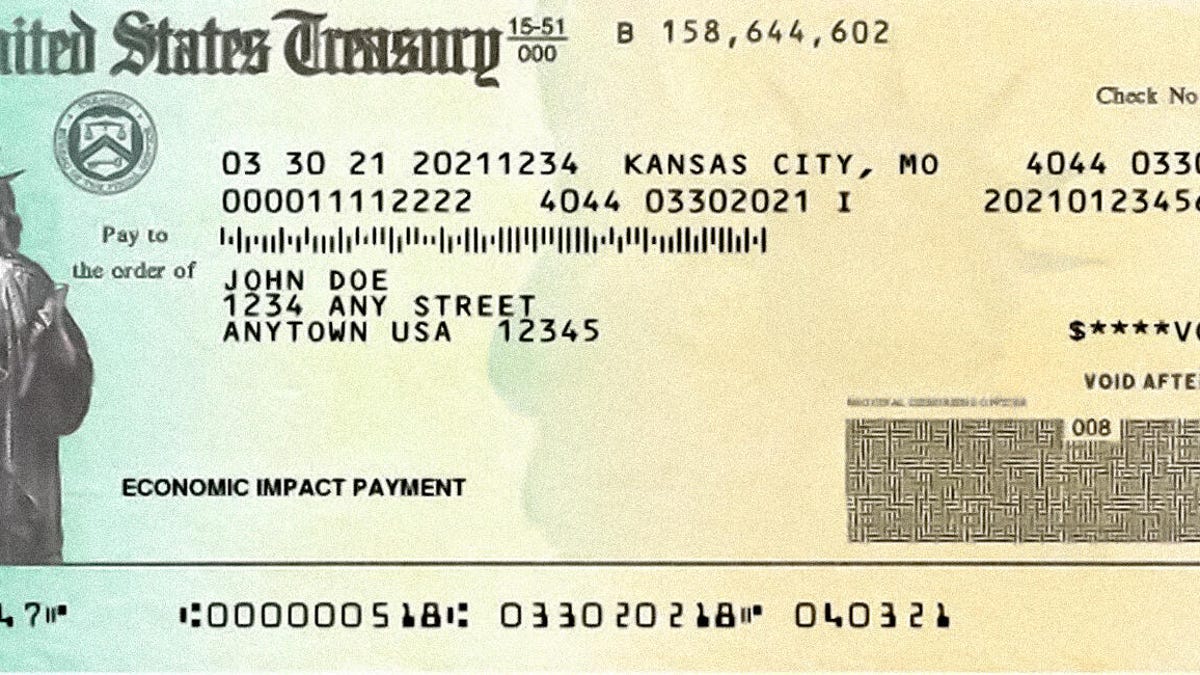

Gephardt How To Tell If A Surprise Tax Refund Is Real

Third Stimulus Check Update How To Track 1 400 Payment Status 12news Com

Irs Stimulus Checks Frustrated Americans Left Waiting For Payments As Internal Revenue Service Sends Funds To Wrong Accounts Amid Coronavirus Pandemic Abc7 Chicago

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

Yqya Stimulus Check Delays And How Soon You Could See Your Money Kgan

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Social Security Recipients Should Expect Stimulus Payment By April 7 Says Irs The Washington Post

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

So There S No Fourth Stimulus Check But You Can Still Get A Child Tax Credit Wkrc

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

Missing Irs Stimulus Or Tax Refund Payments Prospera Credit Union

Here S The No 1 Thing Americans Do With Their Tax Refund Gobankingrates

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Your 2020 Stimulus Check How Much When And Other Questions Answered